salt tax deduction repeal

Katie Porter D-Irvine co-sponsored the latest effort to roll back a. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts.

. The Supreme Court declined to hear an appeal from four states that would have repealed the State And Local Tax SALT deduction cap which was put in place by the Tax Cuts and Jobs Act of 2017. In April 2021 as the Build Back Better Act was being debated in the House a bipartisan group of House lawmakers formed the SALT caucus to advocate for the repeal of the 10000 limit on the state and local tax deduction. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax.

In states that have PTET legislation a pass-through entity elects to pay state-level taxes at the entity level rather than passing on the full tax liability to individual owners with state tax credit to individual owners for state taxes paid by the entity. To wrap up this week we will talk a little bit about taxes. The entity which is not subject to the SALT cap may claim a federal Section 164 business expense deduction and shareholders.

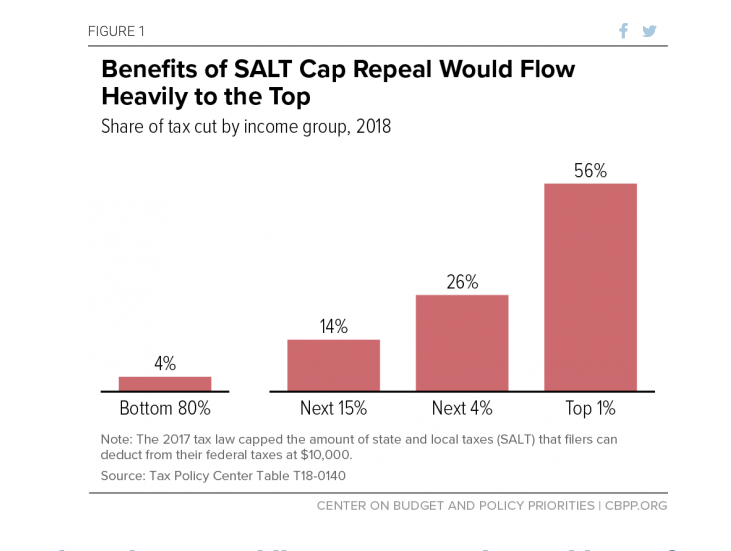

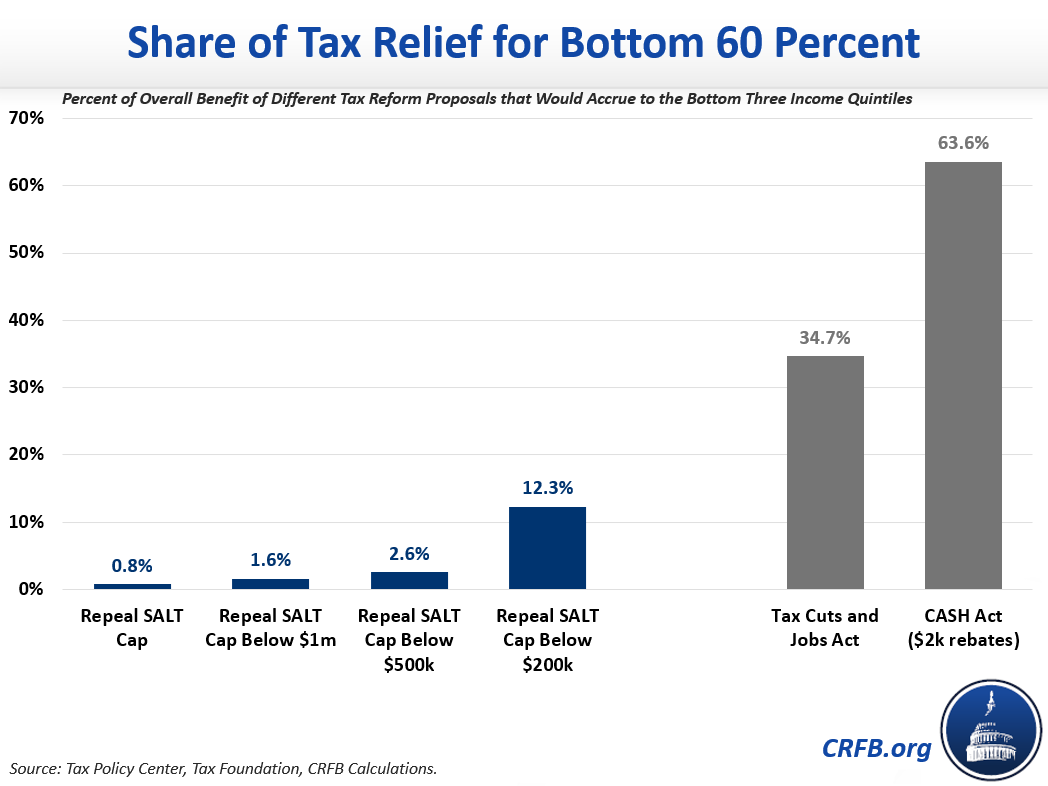

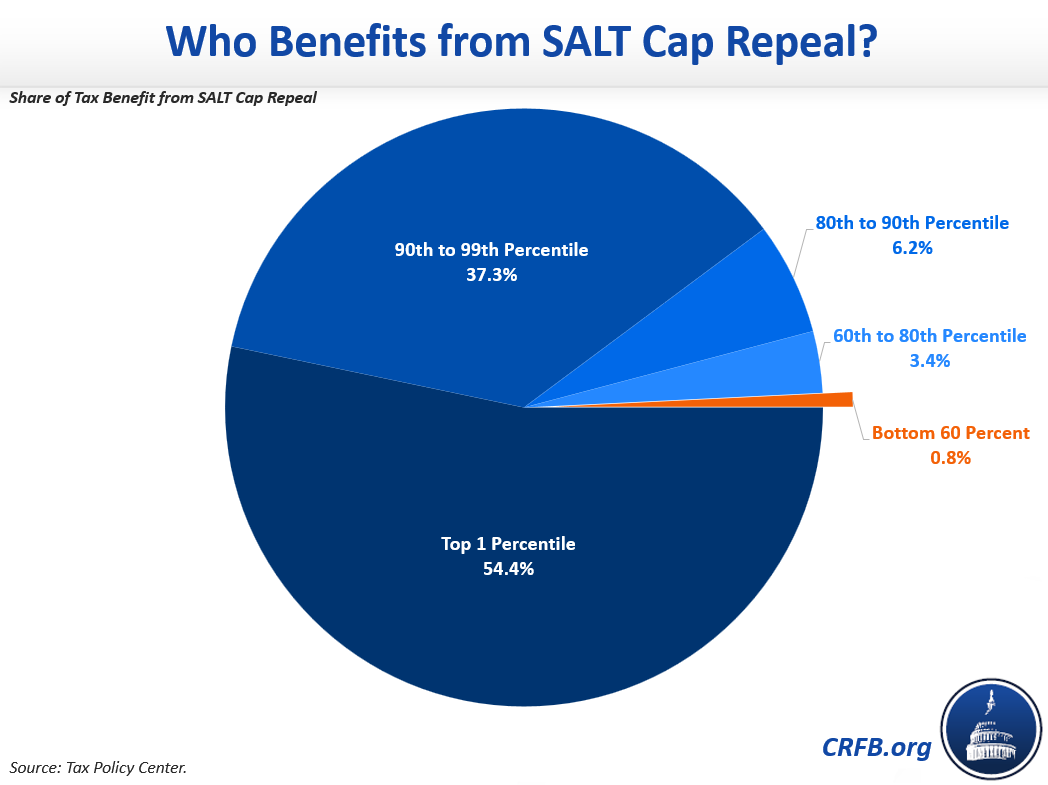

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. They later threatened to block the bill if a raise on the SALT deduction were not included. There is widespread recognition across the political spectrum that the vast majority of the SALT deduction benefits the wealthy and a repeal of the cap on the SALT deduction would amount to a tax break for the wealthiest Americans.

SALT change on ice in the Senate. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Democrats are angling to repeal a Trump-era limit on state and local tax deductions as part of President Bidens signature spending plan but a new analysis shows how the bulk of the proposal.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. Gottheimer and other members of the New Jersey SALT Strike Team want a full repeal of what they called the disastrous cap on the State and Local Tax SALT deduction.

A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are trying to slam the brakes on. This differs from a credit which decreases the amount you owe also known as taxable. Porter-backed bill seeks to restore SALT deductions capped under 2017 tax act Rep.

Like the standard deduction the SALT deduction lowers your adjusted gross income AGI. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns.

Prior to the Republican tax reform of 2017 tax filers could deduct all of. The change may be significant for filers who itemize deductions in high-tax states and currently can. How the SALT deduction works.

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. The cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. Learn More at AARP.

However it also instituted a 10000 deduction cap on state and local taxes. On Trump Was Right About the SALT Cap. The Tax Cuts and Jobs Act of 2017 slashed taxes for the rich and corporations with 83 percent of the benefits trickling up to the top 1 percent.

By Naomi Jagoda - 010922 623 PM ET. Pelosi defends SALT deduction in Dems spending bill insists it wont benefit the rich Pelosi contradicts nonpartisan analyses showing SALT repeal is boon to the rich. A Democratic proposal aims.

Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. That should spell the end for the SALT deduction a benefit for high earners in high-tax states. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state.

Democrats are at loggerheads over a progressive Trump-era revision to the tax code. Joe Manchin D-WVa raised broader. Over 50 percent of this reduction would accrue to taxpayers in just four.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Enacted by the Tax.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Deduction Resources Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Why Repealing The State And Local Tax Deduction Is So Hard

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It